5 Reasons to Monitor Your Credit Score

Your credit score is an important number that can determine your financial well-being. It is a reflection of your past borrowing habits and can affect your ability to obtain loans, credit cards, and even housing. Monitoring your credit score regularly can help you spot inaccuracies and fraudulent activity, as well as make informed decisions about your financial future. Here are five reasons why you should monitor your credit score:

1. Identify Errors on Your Credit Report

Monitoring your credit score can help you identify errors and inaccuracies on your credit report. These errors could include incorrect personal information, accounts that have been closed or paid off but are still listed as open, or unauthorized applications for credit. If left unchecked, these errors could negatively impact your credit score and cause you to pay more in interest rates and fees.

2. Protect Against Identity Theft

Criminals can use your personal information to open accounts or apply for credit in your name without your knowledge. Monitoring your credit score can help you spot potential identity theft before it becomes a major problem. Alert notifications can help you take action as soon as possible. This can help prevent any further damage to your credit and save you time, money and stress.

3. Improve Your Credit Score

Knowing your credit score and credit history can help you take actions to improve it. If you have a low credit score, you can make a plan to pay off debt, add positive payment history by making payments on time and work to improve your credit score. This could help you qualify for lower interest rates and improve your overall financial health.

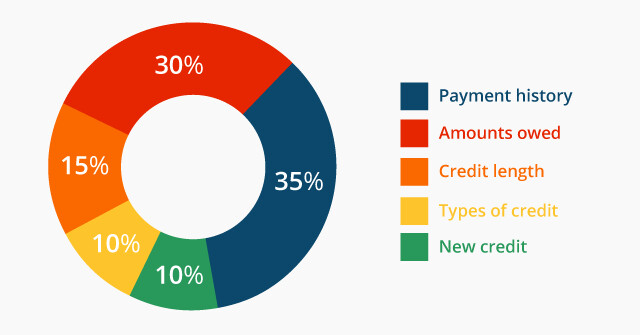

4. Gain Financial knowledge

Credit scores can be complicated, and monitoring your score can help you understand how lenders evaluate your creditworthiness. With information being available on different lenders so you can make informed decisions about which credit products to apply for and where you stand before utilization rates.

5. Qualify for Lower Interest Rates

Having a good credit score can help you qualify for lower interest rates on loans, credit cards, and other financial products. By monitoring your credit score, you can work towards improving it, thereby increasing your chances of qualifying for lower interest rates and saving money in the long run.

How to Monitor Your Credit Score

Monitoring your credit score is now easier than ever. With the availability of credit monitoring services, you can receive alerts when there are important changes to your score or report, and benefit from credit score check options. When you sign up, you’ll receive updates on the various financial information that reports to the credit bureaus through a confidential and secure service. One of the affiliate links to such services is the one below.

Click here to learn more about Credit Monitoring Services.

Conclusion

Monitoring your credit score regularly can give you peace of mind, and help you make informed decisions about your financial future. Through regular monitoring, you can identify errors on your credit report, protect yourself against identity theft, improve your credit score, gain financial knowledge and qualify for lower interest rates. Taking advantage of credit monitoring services can make these tasks easier and more efficient, so don’t hesitate to sign up today.