Understanding Refinance Loans: What You Need to Know

Whether you are looking to consolidate debt, lower your monthly payment, or take cash out for large expenses, refinancing your loan can be a viable option. Refinancing your loan may enable you to lower the interest rate and lower the amount of payments.

When it comes to refinancing your loan, here are some key points you should understand:

What is Refinancing?

Refinancing is a process where a borrower takes out a new loan to pay off an existing loan. This process helps the borrower to reduce monthly payments by lowering the interest rate on the new loan.

Benefits of Refinancing

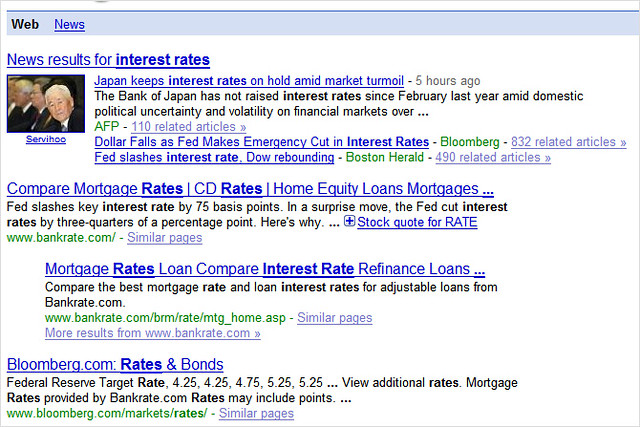

- Lower Interest Rates: Refinancing your loan may get you a lower interest rate than you had when initially taking out your loan.

- Pay off Principal Faster: When you refinance your loan, you may be able to pay off the principal faster by spreading out the amount you owe over a longer period of time.

- Consolidate Debt: You may be able to consolidate multiple loans into one by refinancing your loan.

- Cash Out Equity: You may be able to take out some of the equity in your home to use for large expenses. This money can be used to pay for home repairs, tuition, and other large expenses.

Drawbacks of Refinancing

- Might be Costly: Refinancing a loan can be costly if you have to pay closing costs and other fees. Additionally, if you break the terms of your original loan, you may be subject to prepayment penalties, which can add up.

- Long-Term Commitment: When refinancing your loan, you are making a long-term commitment. Since the terms of the new loan may be different than the original, it’s important to make sure that you can manage the loan payments over the life of the new loan.

Who Qualifies for Refinance Loans?

When it comes to qualifying for a refinance loan, the requirements are similar to any other type of loan. Before you can be approved, lenders will look at your credit score, debt to income ratio, income, and employment history. Additionally, you’ll need to have enough equity in your home to qualify. The amount of your current loan and other factors will determine how much equity you need.

Refinancing your loan can be a great way to save money. However, it’s important to make sure that you understand all the terms and conditions associated with the loan. Keep in mind the benefits and drawbacks that come with refinancing your loan.