How Credit Monitoring Can Help You Protect Your Finances

Introduction

Protecting your finances is crucial in today’s fast-paced and digitized world. One method that can help you stay on top of your financial health is credit monitoring. By regularly monitoring your credit activity, you can identify any potential threats or suspicious behavior that could harm your financial stability. Fortunately, there are excellent credit monitoring services available that can provide you with the necessary tools to safeguard your finances.

1. Real-Time Alerts

One of the primary benefits of credit monitoring is receiving real-time alerts. Whenever there is a significant change in your credit report, such as a new account being opened or a late payment, you receive immediate notifications. This allows you to quickly respond and investigate any unauthorized activities, minimizing any potential damage to your finances.

2. Identity Theft Protection

Credit monitoring services offer advanced identity theft protection. They constantly scan and monitor your personal information, including your social security number and credit card details, for any signs of unauthorized usage. If any suspicious activity is detected, you will be promptly notified, allowing you to take swift action to prevent any further damage.

3. Credit Score Tracking

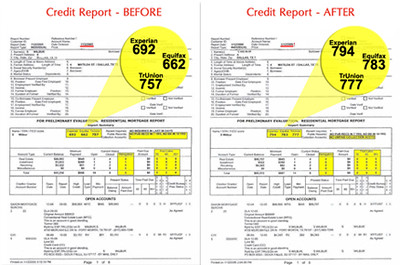

Monitoring your credit score is a vital aspect of maintaining a healthy financial profile. Credit monitoring services provide you with regular updates on your credit score, allowing you to keep track of any fluctuations. By understanding your credit score, you can make informed decisions when it comes to taking out loans, applying for mortgages, or managing your credit overall.

4. Fraudulent Account Detection

With credit monitoring, you can detect fraudulent accounts before they cause significant harm. By analyzing your credit report in detail, these services are capable of identifying any suspicious account openings that you may not be aware of. Discovering these accounts early on allows you to take immediate action and prevent further fraudulent activities.

5. Public Records Monitoring

Credit monitoring services have the ability to monitor public records associated with your personal information. This includes bankruptcies, liens, and court judgments. Regular monitoring of these records ensures that you are aware of any potential issues that may affect your financial well-being. Being informed allows you to address these concerns before they escalate and negatively impact your creditworthiness.

6. Credit Utilization Analysis

Effective credit monitoring services also provide analysis of your credit utilization. They help you understand how much of your available credit you are utilizing and how it affects your credit score. By optimizing your credit utilization, you can improve your overall creditworthiness and financial standing.

7. Financial Planning Assistance

Credit monitoring services often offer additional financial planning assistance. They provide personalized recommendations and insights based on your credit profile and financial goals. These valuable tools can help you make smarter decisions when it comes to managing your finances, saving money, and achieving your long-term objectives.

8. Secure Online Access

Most credit monitoring services provide secure online access to your credit reports and scores. This grants you the convenience to regularly review your financial information at your own pace. Easy accessibility ensures that you can stay up to date with any changes and take control of your financial future.

9. Actively Taking Control

By utilizing credit monitoring services, you actively take control of your finances. Instead of waiting for potential issues to arise, you are proactively monitoring your credit to ensure its safety. Timely identification of fraudulent activities can save you from the extensive recovery process that accompanies becoming a victim of financial fraud.

10. Protect Your Finances Today!

Click here to start protecting your finances with reliable credit monitoring services. Don’t wait until it’s too late! Safeguard your financial well-being and enjoy peace of mind knowing that your finances are secure.