Unlocking Your Financial Freedom with a Personal Loan

Are you looking for a way to break out of your financial struggles and achieve a stronger financial footing? A personal loan could provide a boost and enable you to make positive strides towards financial freedom. Here, we’re going to look at unlocking financial freedom with a personal loan.

What are Personal Loans?

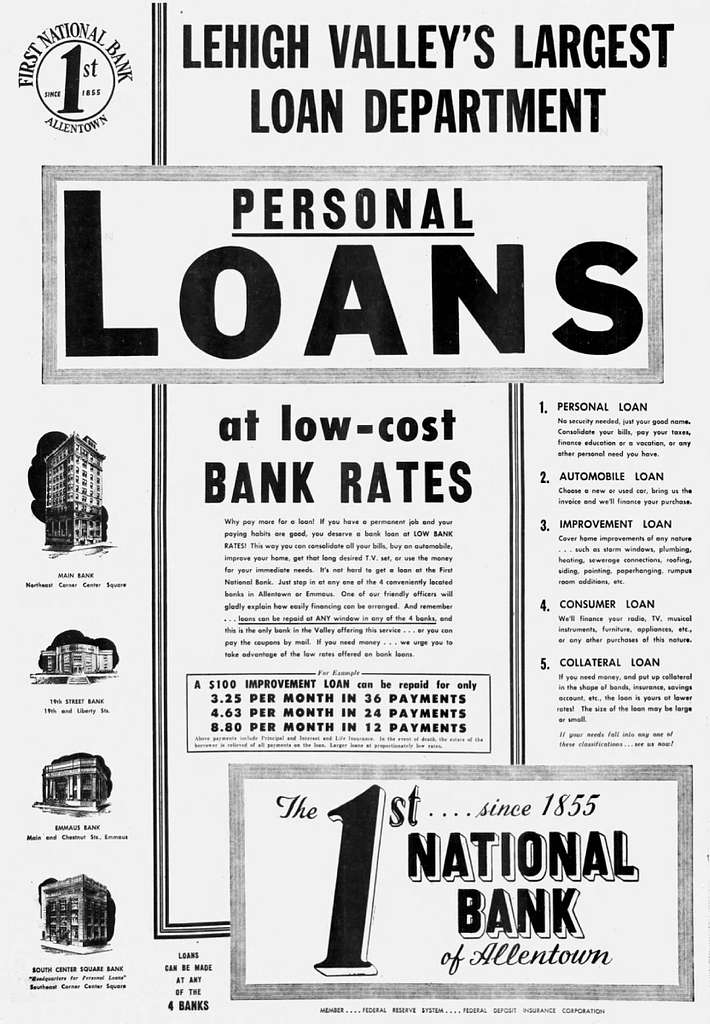

Personal loans are a source of funds you can use to consolidate debt, make a large purchase, or cover other expenses. Essentially, they’re loans with freedom around what you use the funds for, making them an attractive option when looking to consolidate a broad range of debts or make purchases for which you may not have the cashflow available. With personal loans, there are typically two main types, those with a secured and unsecured option.

Personal loans with a secured option allow a borrower to leverage an asset to help secure the loan. For instance, a car loan is a type of secured personal loan as the car itself can be used to secure the cost of the loan and ensure it’s paid back. In comparison, unsecured personal loans don’t require any assets to help secure the loan. Instead, unsecured personal loans are typically offered to those with a strong financial background and better credit rating.

The Advantages of a Personal Loan

The advantages of a personal loan are that it can provide a quick, secure source of money that can help pay for a range of large expenses. Personal loans can help you cover unexpected costs, such as repairs to your home or to your vehicle. Personal loans are also available on relatively short notice, with loans often being approved and paid out within a couple of weeks in most cases.

The flexibility of personal loans makes them particularly attractive for those who need a loan for a wide range of purposes. For instance, if you’re looking to consolidate debts from a variety of sources, such as credit cards and other loans, a personal loan can provide a convenient solution. Likewise, if you’re planning a big purchase such as a car or a house, a personal loan can help you cover a large chunk of the cost.

Getting Started with a Personal Loan

Ready to start taking control of your finances? You can begin by researching personal loans that suit your needs and comparing quotes. It’s important to research all the lenders available, compare interest rates and find the best deal to suit your financial situation. You can find a variety of lenders online, and compare your options with a personal loan today.

Conclusion

Personal loans can help put you on a more secure financial footing, allowing you to break out of financial struggles and enjoy financial freedom. From consolidating debts to making large purchases, personal loans are a practical, convenient way of achieving those goals. Get started today by comparing your options and finding a loan that will suit your needs.