How to Get the Best Auto Loan Rates for Your Vehicle

Buying a car can be a daunting task, especially if you’re not sure where to begin. One important piece of the puzzle is getting the best auto loan rates for your vehicle. With a good auto loan, you can get the car of your dreams without breaking the bank.

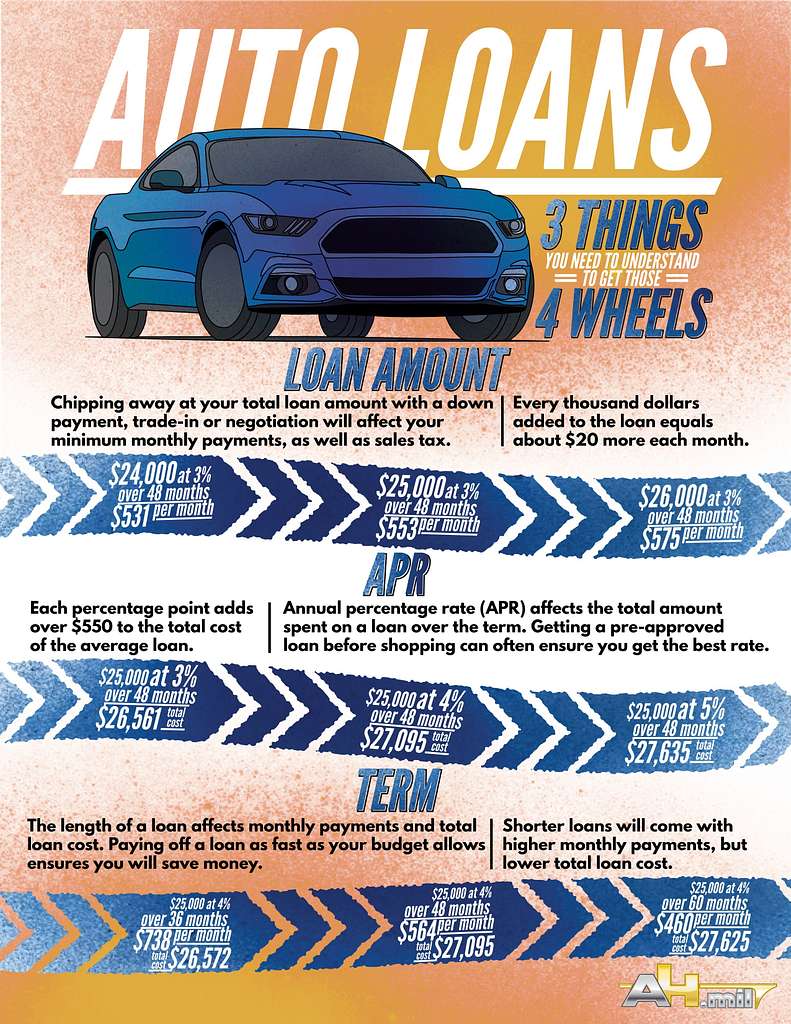

Before you start looking for a loan, it’s important to know what you should expect. Generally, auto loan rates can range anywhere from 2 to 6 percent, but this depends on the type of lender you use and the customer’s borrower profile. It also matters if the buyer is purchasing a new or used vehicle.

Steps to Find Auto Loan Rates

- Research different lenders. You want to work with someone that you trust.

- Check your credit score before applying for loans.

- Compare interest rates from multiple lenders.

- Understand the different types of loans available.

- Talk to salespeople at dealerships.

- Look for special offers or incentives.

- Read the fine print of your loan agreement.

Tips for Negotiating

When it comes to negotiating, you can get the best auto loan rates by being well-informed. Here are a few tips to help you:

- Explore state and federal incentives, such as special interest rates, tax credits, and discounts.

- Build a positive relationship with the dealership.

- Negotiate an lower loan rate than the one originally offered.

- Make sure you understand the terms of the loan.

- Understand the factors that affect your auto loan rate, such as credit score.

- Shop around for the best interest rates.

- Look for potential things to use as bargaining chips, such as a trade-in vehicle.

Finding the Best Auto Loan Rates

Finding the best auto loan rates for your vehicle doesn’t have to be complicated. By researching different lenders, understanding the different types of loans available, and negotiating rates, you can get the best auto loan rate for your vehicle.

If you’re looking for an auto loan, check out Weathercheckers for the best auto loan rates. They offer low rates and an easy online application process, so you can quickly get approved for a loan.