Introduction to Credit Repair

Credit repair is a process of restoring a good credit standing by addressing damaging marks on a credit report. Having bad credit can make it difficult, if not impossible, to get a loan or make purchases involving credit. For this reason, many people turn to credit repair services to help them get their finances back on track.

Steps to Credit Repair

Before attempting to repair a credit score, it is important to understand the main steps for credit repair. The following are the steps to get on the right track with credit repair.

Step 1: Obtain Copies of Credit Reports

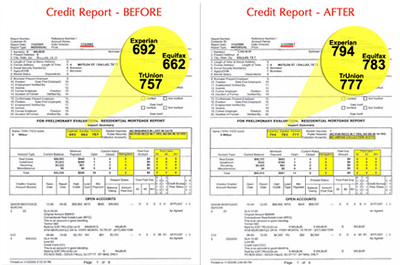

The first step in the credit repair process is to obtain copies of all three of your credit reports. Each of the major credit reporting bureaus — Experian, TransUnion, and Equifax — are required by law to provide you with one free copy of your credit report per request. It is important to make sure that all of these credit reports contain accurate information about you and your financial activities.

Step 2: Identify The Issues on Your Credit Report

Once you have obtained copies of your credit reports, your next step should be to look them over for errors or inaccuracies. Common errors found on credit reports include incorrect personal information, accounts that have been closed by banks but remain open on the reports, or charge-off accounts that have been paid but remain listed as unpaid.

Step 3: Dispute Inaccurate Items

If you find any inaccuracies on your credit reports, then your next step will be to contact the credit reporting bureaus and dispute them. This can be done by writing a dispute letter and sending it to the credit bureau. The dispute process can take up to 30 days, depending on the complexity of the dispute.

Step 4: Take Steps to Improve Your Credit Score

Once your credit reports are free of inaccurate information, it is important to take steps to improve your credit score. This can be done by making on-time payments, paying down existing debt, and avoiding taking on new debt. It is also important to avoid opening too many credit accounts in a short period of time.

Conclusion

Credit repair can be a long and complicated process, but it is worth it in the end. By following the steps outlined above, you can get your finances back on track and start building a strong credit history.