5 Tips for Fast and Effective Credit Repair

The process of credit repair can be a daunting task. You may be feeling overwhelmed and anxious about how you’re going to repair your credit in a short amount of time. Fortunately, there are several strategies you can use to get your credit back on track quickly and effectively. Here are five tips you can follow to improve your credit score fast.

1. Review Your Credit Reports

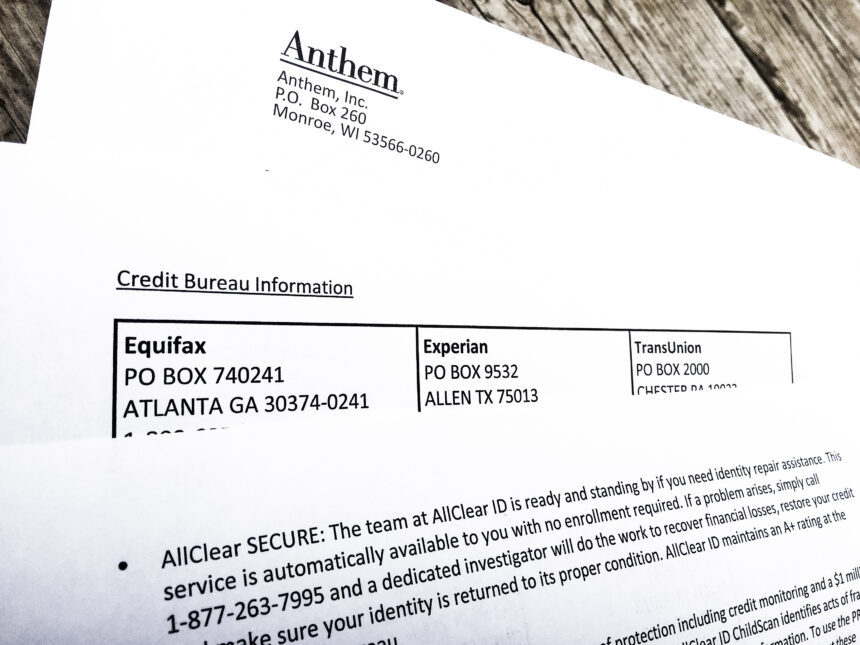

The first and most important step in the credit repair process is to review your credit reports. Make sure all the information is correct and up to date. Check for any errors or negative items that may be erroneous and dispute anything that doesn’t seem accurate. You can check your reports for free online, or you can order them from one of the major credit bureaus. It’s important to review your reports at least once a year to make sure all the information is accurate so you can make the necessary changes.

2. Make Payments On Time

Making payments on time is one of the best things you can do to improve your credit score. Even if you can’t pay the full amount on a specific bill, make at least the minimum payment to ensure the debt isn’t reported to the credit bureaus. Additionally, it’s important to make sure you pay off any outstanding debts as soon as possible, as they can stay on your report for up to 7 years after they are discharged.

3. Pay Off High-Interest Credit Cards

High-interest credit cards are one of the worst things for your credit score. Not only do they have insanely high interest rates, but they also can stay on your record for a long time. Try to pay off these cards as quickly as possible to reduce the damage they can do to your credit score. Additionally, you can look into balance-transfer credit cards to help lower your interest rates and pay off your debt faster.

4. Keep Credit Utilization Low

Another important factor to consider is your credit utilization ratio. This is your total credit limit divided by your total balance. Aim to keep your credit utilization at 30% or below. The lower your ratio, the better your score will be, so try to pay off as much of your balance as you can as quickly as you can.

5. Monitor Your Credit

Finally, it’s important to keep an eye on your credit score. You can get free credit monitoring services online, or you can check your credit score periodically to ensure that it’s not dropping. Remember, it takes time to repair your credit, so be patient and stay diligent about monitoring your score.

By following these five tips, you can start repairing your credit quickly and effectively. Keep in mind that everyone’s situation is different, so the advice in this article may not apply to everyone. However, these tips can give you an idea of where to start and how to make the credit repair process as stress-free as possible.