How to Repair Your Credit and Get Back on Track Financially

Step One: Get an Understanding of Your Credit Report

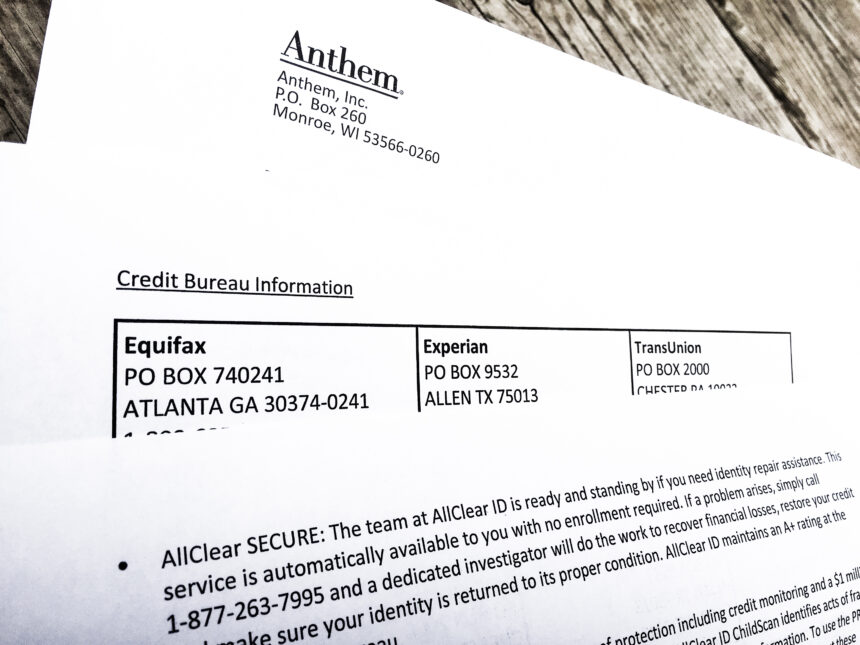

The best place to start is by getting a detailed understanding of your credit report. There are three major credit reporting agencies, and you should make a point to obtain a copy of your credit report from each one of them – Equifax, Experian, and TransUnion. Together, these reports form your credit history and are used to determine your credit score.

By reviewing the report in detail, you can easily identify any negative items. Be aware of any errors, and disputes these through the reporting agency or directly with the creditor. It’s worth noting that you can obtain a credit report free of charge once each year.

Step Two: Make Sure All Your Payments Are Being Reported

Your payment history has a major impact on your credit reports. Creditors will record the payment history for each account. This information is then automatically transferred to the credit bureaus, and the good or bad payment marks will be included on your credit report.

In some cases, creditors may not report timely payments, or they may have stopped reporting activity on the account altogether. You should contact the creditor to verify that payments are being reported accurately. This will help ensure that all of your payments show up on your reports.

Step Three: Dispute Any Negative Items on Your Reports

If your credit report includes negative items, such as late payments or collection accounts, you should dispute them with the credit reporting agency immediately. You have the right to dispute these items if you feel that they have been falsely applied to your report.

When filing a dispute, make sure to provide detailed reasons for the dispute, as well as copies of any supporting documentation. The credit bureau will then investigate the issue and update your report accordingly.

Step Four: Consider Debt Negotiation Services

If you have a large amount of debt, you may want to consider a debt negotiation or debt settlement service. These services specialize in reducing outstanding balances by negotiating with creditors. They can often reduce the amount you owe by a significant amount, which can help you get back on track financially.

Just remember to be careful when selecting a debt negotiation service. Not all services are created equal. Do your research and make sure that the company you choose is reputable and trustworthy.

Step Five: Make Smart Financial Decisions Going Forward

The best way to stay on top of your credit is to take proactive steps to avoid getting into debt in the first place. Financial best practices include living within your means, having an emergency fund, and only taking out loans that you can pay back in full.

Pay close attention to your spending habits and make sure that your income is greater than your expenses. Take steps to build your savings, and pay off any outstanding debt as quickly as possible.

Conclusion

Repairing your credit can seem like an overwhelming task, but it is possible if you take the right steps. Start by obtaining a copy of your credit reports, verifying that payments are being reported correctly, and disputing any negative items. Consider a debt negotiation service if needed, and be proactive in your approach to finances. With a little effort, you can get back on track financially.