Unlock Your Credit Potential: Learn How To Repair Your Credit Score

Having a good credit score is essential, as it can affect your ability to apply for loans, credit cards, and services such as renting an apartment. To reap the benefits of a good credit score, you need to understand how credit scoring works and what you can do to repair your credit score. This article will offer helpful tips for improving your credit score and unlocking your credit potential.

Understand Credit Scoring

Credit scoring is a complex process, but understanding the basics of how it works can help you repair your credit score. Generally, credit scores are based on information from a credit report that includes data on payment history, credit utilization, and any collections or filings. Paying your bills on time and keeping your credit utilization rate low are essential for maintaining a good credit score.

Check Your Credit Report for Errors

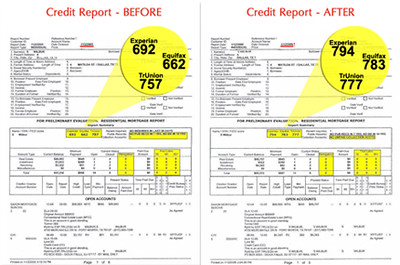

It is important to review your credit report regularly to ensure that all the information contained in it is accurate. If you identify any incorrect information on your credit report, be sure to dispute it with the relevant credit bureaus. This can result in the corrections of errors that can damage your credit score.

Pay Your Bills on Time

Your payment history is the most important factor in your credit score. To ensure your payments are on time, you may find useful setting up automated payments. Making all your payments on time can eventually result in a noticeable improvement in your credit score.

Keep Your Utilization Rate Low

Credit utilization is the amount of your available credit that you are using, and keeping your utilization rate low is essential for maintaining a good credit score. Aim to keep your utilization rate below 25 percent, and make sure to pay off all your card balances in full each month.

Seek Professional Help

In some cases, credit repair services may be the best option to quickly restore your credit score. Credit repair companies can review your credit report and identify potential errors or outdated information, as well as negotiate with creditors on your behalf to resolve any outstanding issues.

With a few simple steps, you can improve your credit score and access the benefits of having a good credit score. Understanding how credit scoring works, regularly checking your credit report for errors, paying your bills on time, keeping your utilization rate low, and seeking professional help can help you unlock your credit potential.